Purchase Process

No Time to Read It All? Here's the Quick Summary: Buying property in Spain in 2025 remains a smart move for foreign buyers. Despite global uncertainty, demand is high, supply is tight, and prices are [...]

Listen to the Article Spain has long been a top destination for foreign property buyers. Its sunny weather, vibrant culture, and affordable living costs make it an attractive option for second homes, investment [...]

Buy a House in Spain by Yourself, with a Lawyer, with a Real Estate Agent, or with a Property Hunter

Listen to the Article Buying a house in Spain is a dream for many. The beautiful landscapes, pleasant climate, and vibrant culture make Spain an attractive destination for property investment. But how should [...]

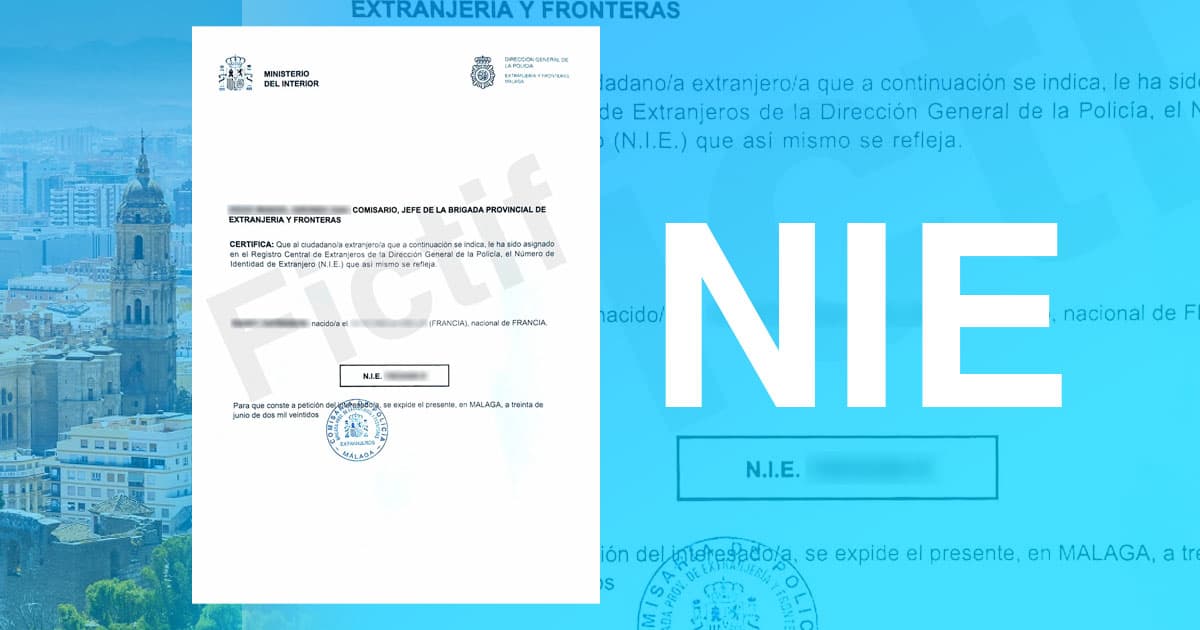

Listen to the Article Introduction Buying property in Spain is a dream for many. The sunny climate, beautiful landscapes, and rich culture make it an attractive destination for both holiday homes and permanent [...]

Listen to the Article Are you thinking of investing in property in the land of Flamenco? Are you wondering whether you should make a purchase now or in the future? People have different understandings [...]

Listen to the Article Spain, with its beautiful landscapes, vibrant culture, and pleasant climate, is a dream destination for many. Whether you're looking for a vacation home, a retirement haven, or a lucrative [...]

Listen to the Article Spain, with its picturesque landscapes and pleasant climate, has become a prime destination for real estate acquisition, especially for primary residences. This article aims to enlighten foreign and French buyers [...]