Guide

When buying property in Spain as a foreigner, it is crucial to understand exactly what the Spanish notary (notario) does — and what they do not do. Many international buyers assume the notary protects them...

Spain continues to attract U.S. buyers with its sunny climate, relaxed lifestyle, and lower cost of living. Essentials like groceries, dining out, and healthcare are often far cheaper than in the U.S., especially in cities like...

Long-term rentals in Spain have become one of the most reliable and tax-efficient property investment strategies in 2025. With rental demand surging, especially in key cities and commuter zones, and new housing laws providing legal clarity and financial incentives

Buying a home in Spain continues to attract thousands of retirees, expats, and international investors every year. The country’s Mediterranean lifestyle, affordable cost of living compared to much of Europe, and stable real estate market make it a...

Buying in Spain starts with one crucial choice: real estate agent (seller’s agent) vs property hunter (also called a buyer’s agent / property finder). A seller’s agent is hired—and typically paid—by the seller to market a specific property and optimize...

Buying property in Spain is generally cheaper than in the U.S. On a price-per-area basis, Spain averages ~€2,000–2,500/m²; U.S. metros commonly run ~$200–$350/ft² (the national median sale price is ~$410k, so units aren’t directly comparable). Closing...

The Spanish school system is decentralized, with compulsory education from ages 6 to 16, though most children start free public preschool at age 3. Families can choose between: Public schools: free, local catchment-based, taught in Spanish or...

panish school holidays in 2025-2026 are built around three main breaks: Christmas: 22 December – 7 January Easter (Semana Santa): 30 March – 6 April Summer: late June to early September, lasting about 11 weeks There are no national...

In 2025, Spanish coastal real estate remains one of the most attractive markets in Europe. Prices start at around €1,500/m² in affordable areas such as Murcia, Granada, or the Costa de la Luz, and exceed €5,000/m² in hotspots like the Balearic...

In Spain, advertised property size often refers to the built area with shared spaces, which includes walls, terraces, and a share of common areas. In the USA, square footage only measures net habitable interior space, excluding garages, basements...

In 2025, the cost of living in Spain remains on average 20–30% lower than in France and far below that of Switzerland or Canada. Housing costs vary by city: Madrid and Barcelona are closer to major European capitals, while Valencia, Seville, or...

For the fastest and most stable connection: Choose fibre optic broadband, widely available in major cities. For mobile or temporary use: Go for a 5G plan or a prepaid SIM card. To save money: Compare deals on platforms like Kelisto or Rastreator...

If you’re a retiree from outside the EU, EEA, or Switzerland, Spain’s warm climate and relaxed lifestyle can be incredibly tempting — but the rules of the Schengen Area will shape how long you can stay without a visa. For anyone dreaming of more than...

Thinking about retiring somewhere sunny, affordable, and full of life? Spain has long been one of the world’s favorite retirement destinations, offering a winning combination of year-round sunshine, a relaxed Mediterranean lifestyle, and a cost of...

The Plusvalía Municipal (officially known as IIVTNU) is a local tax in Spain applied when urban property is transferred through sale, inheritance, or donation. It is based on the increase in the value of the land (not the building) during the period...

Selling property in Spain triggers two capital gains taxes: the national CGT (IRPF for residents, IRNR for non-residents) and the municipal Plusvalía tax. The national tax is based on the difference between purchase and sale price, with rates from 19...

The IRNR (Non-Resident Income Tax) applies to anyone who owns property in Spain but is not a tax resident. It must be paid annually — even if the property is not rented out. For non-rented homes, tax is calculated on a deemed income based on the...

The IBI (Impuesto sobre Bienes Inmuebles) is an annual municipal property tax in Spain, based on the cadastral value — not the market price. All property owners, residents and non-residents alike, must pay it. Rates typically range from 0.4% to 1.1%...

Tax differences between Spain’s regions can significantly impact your total purchase cost. For example, Madrid applies a reduced 6% ITP on resale properties and 0.75% AJD on new builds, making it one of the most affordable regions for buyers. In...

Many foreign buyers are surprised to learn that the purchase price is only part of the story when buying real estate in Spain. Depending on the region and type of property, additional taxes and fees can add 11% to 15% to your total cost. Resale homes...

Spain's Digital Nomad Visa, introduced in 2023, allows non-EU remote workers and freelancers to legally reside in Spain while working for foreign employers or clients. Applicants must demonstrate a minimum monthly income of approximately €2,763...

In 2025, Spain offers strong job prospects for foreigners in tech, healthcare, education, tourism, and green sectors. EU citizens can work freely; non-EU nationals need the right visa. Most jobs are full-time with permanent contracts. Salaries range...

In 2025, non-EU citizens need a Spanish work visa to live and work legally in Spain. The best option depends on your situation: the Regular Work Visa is ideal if you have a Spanish job offer; HQP and EU Blue Card are fast-tracked for high-skilled...

Spain’s real estate market keeps attracting thousands of international buyers each year — drawn by its sunny climate, Mediterranean lifestyle, and booming tourism sector. With over 85 million visitors in 2024, short-term rentals remain one of the most...

Looking for the best bank in Spain as an expat or non-resident? Here’s a quick breakdown: Best for Fee-Free Banking: BBVA, N26, Revolut – No monthly fees, great digital banking. Best for Expats & Services: Sabadell, CaixaBank (HolaBank)...

Visas & Residency: Non-EU citizens need a visa before arrival. Overstaying the 90-day limit can lead to fines or deportation. Taxes: Living in Spain 183+ days/year makes you a tax resident, requiring worldwide income declaration. Wealth and...

If you're short on time but need the essentials, here’s a quick breakdown of the Nota Simple Registral in Spain: What it is: A property report from the Spanish Land Registry confirming ownership, debts, and legal status. Why it matters: Essential...

Buying property in Spain in 2025 remains a smart move for foreign buyers. Despite global uncertainty, demand is high, supply is tight, and prices are rising—especially in sought-after areas like Costa del Sol, Madrid, Valencia, and Alicante. Foreigners...

Spain has long been a top destination for foreign property buyers. Its sunny weather, vibrant culture, and affordable living costs make it an attractive option for second homes, investment properties, or permanent relocation. For non-residents...

Spain has long been a favorite destination for property buyers, thanks to its diverse culture, favorable climate, and picturesque landscapes. From 2020 to 2024, the real estate market in major Spanish cities has shown remarkable resilience and growth...

The non-lucrative visa offers several key advantages over not having a visa, especially for non-EU citizens who wish to live in Spain legally for an extended period. Without a visa, you are limited by short-term stay rules, whereas a non-lucrative...

Spain's allure as a destination for relocation remains strong due to its rich culture, welcoming communities, and stunning landscapes. Many ask, “Can I live in Spain full time if I buy a property?” While owning property in Spain offers numerous...

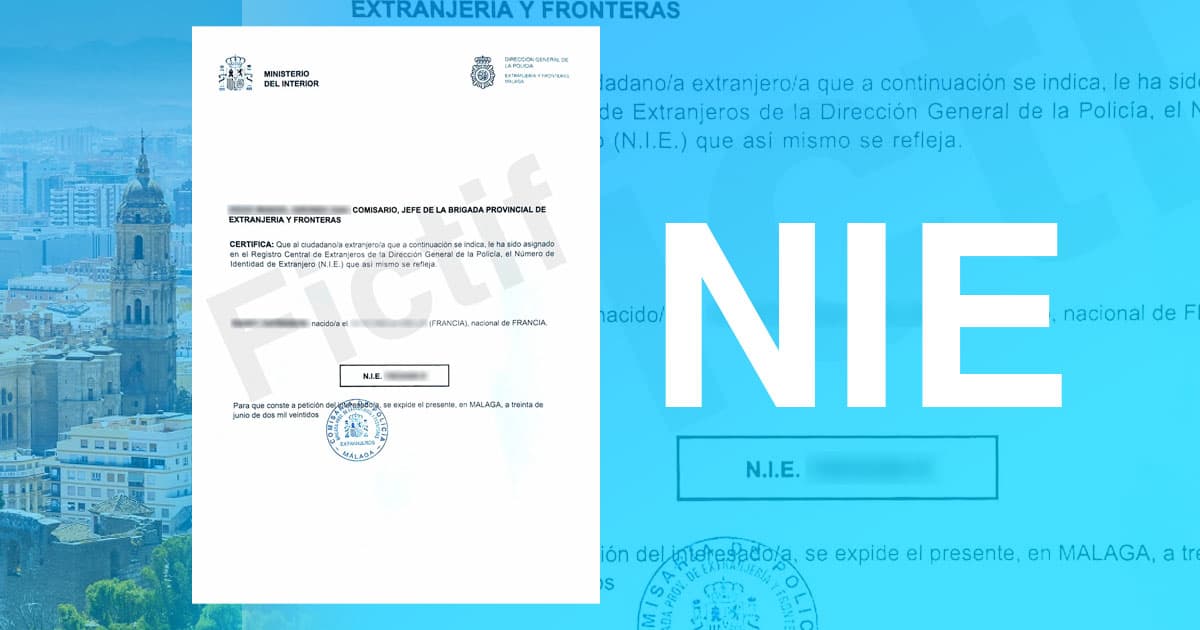

Obtaining your NIE (Número de Identificación de Extranjeros) is essential for any administrative, contractual, or commercial activity in Spain, such as buying property, opening a bank account, or working. To get your NIE, schedule an appointment...

Buying a home in Spain starts with a choice between four paths: go solo, hire legal counsel only (an independent lawyer), work with a real estate agent (seller’s agent/listing agent), or retain a property hunter (buyer’s agent/property finder). Each...

Despite regulatory changes and growing demand, Spain continues to offer compelling advantages for foreign property buyers—whether you’re looking to live, retire, or invest...

Spain, with its beautiful landscapes, vibrant culture, and pleasant climate, is a dream destination for many. Whether you're looking for a vacation home, a retirement haven, or a lucrative investment, Spain offers a plethora of opportunities. But can...