Buying a Property in Spain As a Foreigner: Guide 2025

Last update: February 28, 2025

Reading time: 33.4 min

No Time to Read It All? Here’s the Quick Summary:

Foreigners can buy property in Spain with the same rights as locals. Essential steps include obtaining an NIE, conducting due diligence, signing a private purchase contract, and finalizing the sale with a notary. Mortgages are available with interest rates around 2-3%, but buyers should budget for extra costs like taxes, legal fees, and notary charges.

The Golden Visa program, which previously allowed non-EU nationals to gain residency through a €500,000 property investment, is being discontinued as of late 2024. Existing holders retain their rights, but new applications are no longer accepted. Alternatives such as the Non-Lucrative Visa or Entrepreneur Visa are now the primary pathways to residency.

Popular regions for foreign buyers include Costa del Sol, Barcelona, Madrid, and Valencia. It’s crucial to understand taxes like IBI, income tax on rentals, and capital gains tax. Engaging a lawyer or a property hunter with legal services is highly advised to navigate the complexities and avoid common pitfalls.

Spain’s real estate market is expected to stabilize following the removal of the Golden Visa, with a focus on affordability for residents. Despite this change, the market remains relatively stable, supported by projected economic growth of 2.1% in 2024 and 1.9% in 2025.

1. Introduction

Spain has long been a preferred destination for foreigners looking to buy property, thanks to its pleasant climate, diverse landscapes, and rich cultural heritage. The Spanish real estate market has proven resilient, offering various options that cater to different preferences and budgets. Understanding the nuances of buying property in Spain as a foreigner is essential for a smooth transaction.

2. Legal Framework for Foreigners

Foreigners can purchase property in Spain with virtually the same rights as Spanish nationals. The Spanish legal system provides a secure framework for property ownership, and there are no restrictions on foreign ownership of land or property. Recent updates have streamlined certain legal procedures, making it easier for non-EU citizens to invest in Spanish real estate.

Key Legal Requirements:

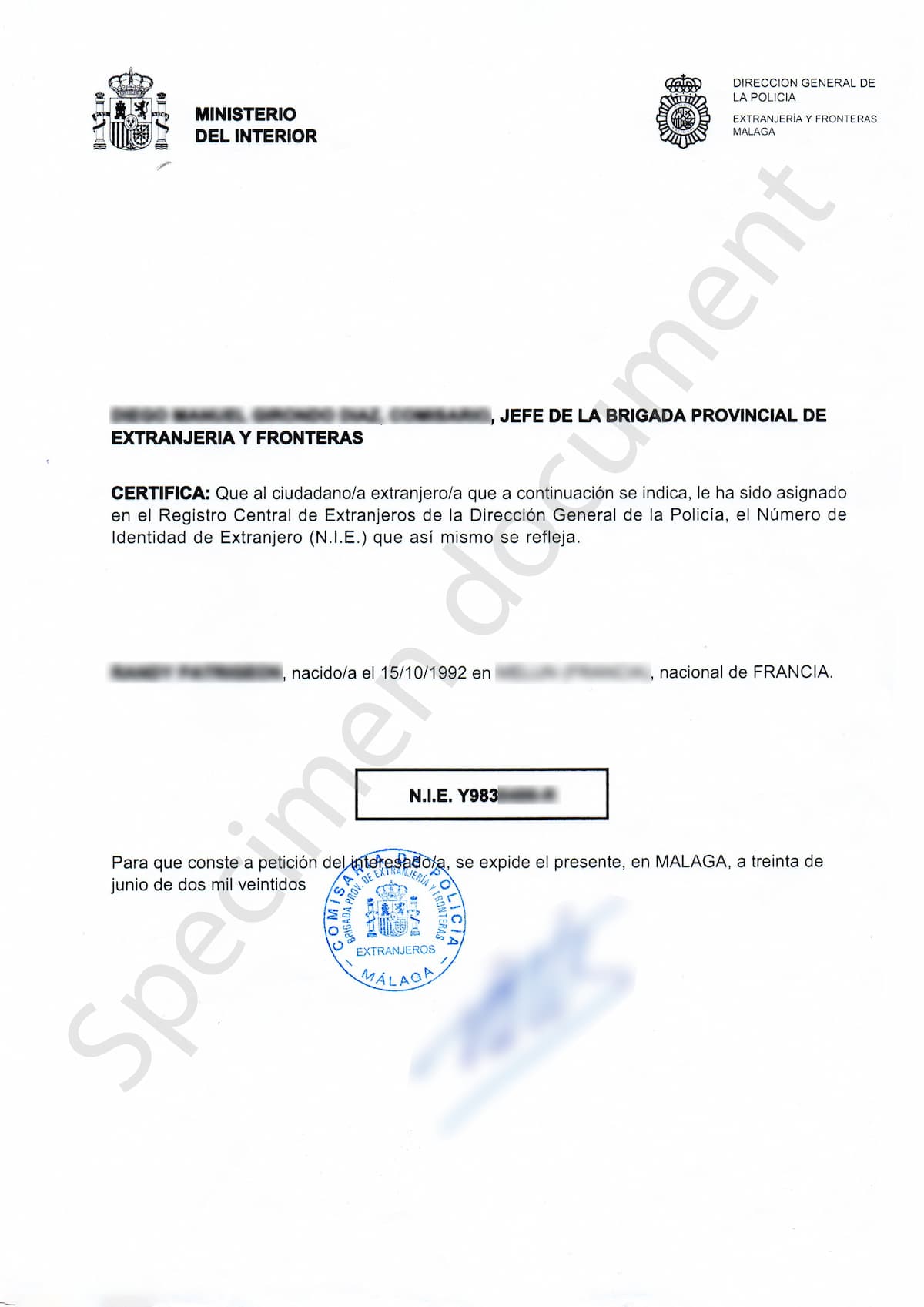

NIE (Número de Identificación de Extranjero)

An identification number required for property transactions. Obtaining an NIE is a crucial step in the process, and we’ve prepared a comprehensive guide to help you through it. Our detailed article explains how to obtain the NIE on your own, covering everything from the necessary documents to step-by-step instructions.

Due Diligence

A thorough legal check of the property’s status is mandatory to avoid issues related to ownership or debts. More details about due diligence

3. Types of Properties Available

Spain offers a variety of property types to suit different needs:

Villas: Ideal for those seeking privacy and luxury.

Apartments: Perfect for city dwellers and those looking for low-maintenance options.

Townhouses: Offer a balance between villa living and apartment convenience.

Rural Properties: Suitable for buyers interested in country living.

Both new builds and resale properties are available, each with its own set of advantages and considerations.

4. The Property Buying Process in Spain

The process of buying property in Spain can be straightforward if you are well-prepared and understand each step involved. The legal framework in Spain is designed to protect both buyers and sellers, but it is essential to follow the correct procedures to avoid pitfalls. Here’s a detailed breakdown of each step in the property buying process and some key advice to help you navigate it successfully.

1. Reservation Agreement

The Reservation Agreement is the first formal step once you have decided on a property. This document is essentially a preliminary agreement between you and the seller. By signing it, you commit to purchasing the property, and in turn, the seller agrees to take the property off the market for a specified period.

- Deposit Payment: A small deposit, usually ranging from €3,000 to €6,000 (or about 1% of the purchase price), is paid at this stage to secure the property. This deposit demonstrates your serious intent to buy and compensates the seller for reserving the property for you.

- Legal Significance: Although this agreement is not legally binding in the way the final deed is, it is a significant step. Breaking the agreement usually results in the forfeiture of your deposit, so only sign it when you are sure about your decision.

2. Due Diligence

Due diligence is the most crucial part of the property buying process. It involves a comprehensive legal examination of the property to ensure it is free of encumbrances and is legally suitable for sale.

- Legal Checks: Your lawyer will verify the property’s legal status by checking the Land Registry (Registro de la Propiedad) to ensure there are no existing debts, mortgages, or legal claims against it. They will also confirm that the seller is the rightful owner and that the property matches the Land Registry’s description.

- Urban Planning Compliance: For properties in certain areas, especially rural or coastal zones, it is essential to check for compliance with local urban planning laws. This step ensures that the property has the necessary licenses and that there are no restrictions or plans for future development that might affect your use of the property.

Advices

- Hire a Specialist Lawyer: Employ a lawyer who specializes in Spanish real estate law. This professional will conduct all necessary checks and safeguard your interests throughout the process.

- Check for Hidden Costs: During due diligence, your lawyer should also check for any unpaid community fees, utility bills, or taxes associated with the property, as these can transfer to the new owner.

3. Private Purchase Contract (Contrato Privado de Compraventa)

Once due diligence is complete and you are satisfied with the property’s legal status, the next step is to sign the Private Purchase Contract. This contract is a more detailed agreement that outlines the terms and conditions of the sale.

- Deposit Payment: At this stage, a more significant deposit is required—usually around 10% of the property’s purchase price. This deposit serves as a financial commitment to the purchase.

- Terms of the Sale: The contract will include essential details such as the purchase price, payment schedule, completion date, and any conditions that must be met before the sale can proceed. It will also stipulate what happens if either party fails to complete the transaction, including penalties.

- Legal Binding: This contract is legally binding. If the seller backs out after signing, they are typically required to pay back double the deposit. If the buyer withdraws, they usually forfeit the deposit.

Advices

- Ensure Comprehensive Terms: Make sure the contract includes all terms discussed, including any fixtures or furniture included in the sale. Your lawyer should draft or review the contract to ensure it protects your interests.

- Consider Payment Protection: If you’re making payments in installments, consider using a bank guarantee or escrow account to protect your funds until the sale is finalized.

4. Notary and Escritura (Title Deed Signing)

The final step in the property buying process is the signing of the Escritura, the official title deed, in the presence of a notary. This step formally transfers ownership from the seller to the buyer.

- Role of the Notary: The notary is a public official who acts as an impartial witness to the transaction. They ensure that all legal requirements are met, verify the identities of the buyer and seller, and confirm that both parties understand the contract’s terms. The notary does not represent either party but ensures the sale is lawful.

- Final Payment: At this stage, the buyer pays the remaining balance of the purchase price. The notary will then issue the Escritura, which both parties sign to complete the transaction.

- Registration: After the signing, the notary will send the title deed to the Land Registry to record the change of ownership. This step is crucial as it legally confirms you as the new owner.

Advices

- Understand the Notary’s Role: While the notary ensures the legal aspects of the sale are in order, they do not perform the in-depth due diligence that your lawyer does. Ensure that your lawyer has cleared all legal checks before reaching this stage.

- Bring Necessary Documents: Ensure you have all necessary documents with you on the day of signing, including your NIE number, passport, and proof of payment for any associated taxes and fees.

A lawyer specializing in Spanish property law is highly recommended to ensure a smooth transaction.

5. Financing Your Property Purchase

Foreigners can obtain mortgages from Spanish banks, with loan-to-value ratios typically ranging from 60% to 70%. The current interest rates in 2024 are around 2-3% for fixed-rate mortgages, making financing an attractive option.

Mortgage Calculator

| Property Value | Down Payment (30%) | Mortgage Amount (70%) | Monthly Payment

% Interest,

Years

|

|---|---|---|---|

| €200,000 | €60,000 | €140,000 | €741 |

| €500,000 | €150,000 | €350,000 | €1,853 |

| €1,000,000 | €300,000 | €700,000 | €3,706 |

| €0 | €0 | €0 |

6. Costs Involved in Buying Property

When buying property in Spain, it’s important to consider the various costs that go beyond the property’s sale price. Being aware of these expenses upfront can help you budget effectively and avoid surprises. Here’s a more detailed breakdown of the key costs involved:

- Property Transfer Tax (Impuesto de Transmisiones Patrimoniales, ITP): This tax applies to resale properties and varies depending on the region, typically ranging from 6% to 10% of the property’s purchase price. For example, in Andalusia, the rate can vary depending on the value of the property. In some regions, there might be reduced rates for certain buyers, such as first-time homebuyers or those buying a primary residence.

- VAT (Impuesto sobre el Valor Añadido, IVA): If you’re purchasing a new build directly from a developer, you will pay VAT instead of the transfer tax. The standard rate for residential properties is 10%. For commercial properties and land, the VAT rate can be higher (typically 21%). Additionally, when buying a new property, you might also have to pay a Stamp Duty (Actos Jurídicos Documentados, AJD), which is usually between 0.5% and 1.5% of the property’s price, depending on the region.

- Notary and Registration Fees: The notary’s fees are regulated and usually amount to around 0.5% to 1% of the purchase price. These fees cover the costs of preparing the official purchase deed (Escritura Pública) and handling the signing process. Registration fees for entering the property in the Land Registry (Registro de la Propiedad) are separate and typically range between 0.5% and 1% of the purchase price. Although these fees might seem minor in comparison to other costs, they are essential for legally securing your ownership.

- Legal Fees: Hiring a lawyer is crucial to ensure the transaction is completed legally and to protect your interests. Legal fees usually amount to around 1% of the property’s purchase price, but they can vary depending on the complexity of the transaction and the lawyer’s experience. This fee covers the lawyer’s work, including conducting due diligence, reviewing contracts, and providing legal advice throughout the process.

- Additional Costs: Beyond the primary costs, there might be other expenses such as bank fees if you’re getting a mortgage, property valuation fees, and the cost of obtaining a NIE number (Foreign Identification Number), which is required for all property transactions in Spain. Some buyers also opt for property insurance and home inspections, which, while not mandatory, can add to the total expenditure.

| Cost Type | Amount (€) |

|---|---|

| Property Price | 300,000 |

| Transfer Tax (8%) | 24,000 |

| Notary and Registry Fees | 3,000 |

| Legal Fees (1%) | 3,000 |

| Total Cost | 330,000 |

Extra Costs Involved in Buying Property

For More Detailed Information on Taxes:

If you want to dive deeper into the topic of taxes when purchasing real estate in Spain, we have a dedicated article that covers everything you need to know. It provides comprehensive insights into all tax-related aspects of property purchase. You can find this detailed guide on our Taxes When Purchasing Real Estate in Spain page.

7. Best Locations for Foreigners

Spain offers a diverse range of cities and regions that cater to different preferences and lifestyles. Here’s an overview of the most popular areas for foreign buyers in 2024:

Price Evolution per Square Meter of Housing for Sale in Spanish Cities.

All the data presented here is sourced from the Idealista website and corresponds to the prices in August of each year. For more detailed information and historical data, you can visit the official report on Evolution of Housing Prices for Sale in Spain (Evolución del precio de la vivienda en venta en España) on Idealista.

Price Evolution of Real Estate (2020-2024)

Malaga: Since 2020, Malaga has experienced remarkable growth in price per square meter, rising from €2,118/m² in 2020 to €3,069/m² in 2024, a 45% increase. This trend indicates that Malaga is offering excellent investment opportunities for buyers seeking an exceptional quality of life by the sea.

Madrid: Madrid continues to be one of Spain’s most dynamic cities, with the price per square meter reaching €4,717/m² in 2024. Although the growth is more moderate at 30% since 2020, it reflects the stability of the capital’s real estate market, which is ideal for those looking to invest in a secure and growing metropolitan area.

Barcelona: Barcelona offers a stable and promising real estate market, with an 11% increase between 2020 and 2024. Prices have reached €4,528/m² in 2024, indicating a steady demand. This makes Barcelona a wise choice for buyers interested in a vibrant and cultural city.

Valencia: Valencia has seen a 46% increase in property prices between 2020 and 2024, rising from €1,824/m² to €2,664/m². This growth reflects the city’s increasing appeal due to its balance between affordable living costs and high quality of life. Now is the perfect time to invest in Valencia before prices rise further.

Gran Canaria: Gran Canaria shows more stable growth, with an 18% increase since 2020, reaching €2,340/m² in 2024. This makes it an interesting destination for buyers seeking a secure investment with prospects for steady growth.

Conclusion

According to Idealista’s figures, the Spanish real estate market is booming, offering numerous opportunities for buyers. Whether you are looking for a holiday home, a rental investment, or a primary residence, now is a great time to buy. Cities like Malaga and Valencia show strong growth, while more stable markets like Madrid and Barcelona offer safe investments. This is the ideal moment to take advantage of the current dynamic in the Spanish real estate market.

8. Taxes and Fiscal Obligations

It’s essential to understand the various taxes and fiscal obligations that come with ownership. These taxes can vary depending on the property’s location, its use (primary residence, holiday home, rental property), and your residency status. Here’s a detailed look at the main taxes you need to be aware of as a property owner in Spain:

Annual Property Tax (Impuesto sobre Bienes Inmuebles, IBI)

IBI is an annual local property tax that all property owners in Spain must pay. It’s similar to council tax in other countries and is used to fund local services such as street cleaning, waste collection, and public infrastructure.

Income Tax on Rental Income

If you decide to rent out your Spanish property, you’ll need to pay income tax on the rental income, regardless of whether you are a resident or a non-resident.

Capital Gains Tax (Impuesto sobre la Renta de No Residentes, IRNR)

Capital Gains Tax (CGT) applies when you sell your property in Spain. It is calculated on the profit made from the sale (i.e., the difference between the sale price and the original purchase price, minus allowable expenses such as improvements and transaction costs).

Wealth Tax (Impuesto sobre el Patrimonio)

Wealth tax is an additional consideration for high-net-worth individuals. It is an annual tax on the net value of assets owned in Spain.

Impact of Golden Visa Elimination on Taxes

The removal of the Golden Visa program may lead to reduced foreign investments in high-value properties. However, it is expected to stabilize real estate prices, particularly in urban areas like Madrid, Barcelona, and Málaga, which were previously impacted by speculative investments linked to the program.

9. Residency and Visa Options

Golden Visa (Investor Visa)

The Golden Visa program, which allowed non-EU citizens to gain residency by investing a minimum of €500,000 in Spanish real estate, is being officially discontinued. The Spanish government has announced its decision to phase out the program to curb speculative investments and address housing affordability issues. While existing holders can continue to renew their visas, no new applications are being accepted as of late 2024.

Non-Lucrative Visa

Designed for non-EU citizens who want to reside in Spain without engaging in work activities. Ideal for retirees or individuals with sufficient passive income, requiring proof of financial means and private health insurance.

Entrepreneur Visa

Tailored for non-EU citizens planning to start an innovative business in Spain. Requires a comprehensive business plan and shows the project’s economic impact and potential job creation.

Student Visa

For non-EU citizens enrolled in educational programs in Spain, allowing them to reside in the country during their studies and work part-time (up to 20 hours per week)

10. Legal Checks and Due Diligence

Title Deed Check (Escritura Pública)

- What It Involves: This check involves verifying that the seller is the legitimate owner of the property. The title deed (Escritura Pública) is an official document that proves ownership and should match the information in the Property Registry.

- Why It’s Important: Ensuring the seller has clear ownership rights prevents potential disputes or claims on the property after the sale.

Property Registry Check (Registro de la Propiedad)

- What It Involves: This step confirms that the property is free of debts, mortgages, or other encumbrances. The Property Registry (Registro de la Propiedad) provides a record of any charges, liens, or legal claims against the property.

- Why It’s Important: Identifying any debts or claims attached to the property is crucial, as these obligations can transfer to the new owner if not resolved before the sale.

Urbanistic Check (Urbanismo)

- What It Involves: This involves verifying that the property complies with local urban planning and zoning laws. This check ensures that the property has the necessary building permits, complies with local regulations, and is not subject to any planning restrictions or demolition orders.

- Why It’s Important: Non-compliance with urban planning laws can result in fines, restrictions on property use, or even forced demolition, posing a significant risk to the buyer.

10. Hiring a Real Estate Agent or Property Hunter

When buying property in Spain, hiring a professional can greatly simplify the process. While a local real estate agent is commonly used, engaging a property hunter (chasseur immobilier) is an increasingly popular option, especially for foreign buyers.

Traditional Real Estate Agent

- Role: A local real estate agent assists in finding properties, negotiating prices, and guiding you through the buying process. They have valuable market insights and can help you find properties that match your criteria.

- Fees: Agent fees typically range from 3-5% of the property price and are usually paid by the seller. This means their services cost you nothing directly, but it’s important to remember that they are primarily motivated to sell properties listed with them.

Property Hunter

- Role: A property hunter works exclusively for the buyer. They provide a comprehensive service, including searching for properties that meet your specific needs, conducting visits on your behalf, and shortlisting the best options. This is particularly beneficial if you live abroad and cannot easily travel to Spain for property viewings. Unlike traditional agents, property hunters often include a legal service within their team, handling all due diligence checks, translations, and legal verifications to ensure that each property is in good standing.

- Advantages:

- Saves Time: A property hunter conducts all preliminary visits, eliminating unsuitable properties and presenting you only with the best options.

- Legal Assurance: They often have an in-house legal team that takes care of all the necessary checks, such as title deeds, property registry status, and urbanistic compliance. This ensures a smoother and safer buying process.

- Convenient for Overseas Buyers: If you are purchasing from abroad, a property hunter manages the entire process on your behalf, ensuring that every property you consider is legally sound and fits your requirements.

- Fees: The property hunter’s fee is usually between 4-5% of the purchase price, paid by the buyer. Although this adds to the overall cost, it often results in savings in the long run by avoiding problematic properties and ensuring all transactions are legally secure.

Advice

- Consider Your Needs: If you are located abroad or want a hassle-free experience, a property hunter can be a valuable asset, handling every aspect from property selection to legal checks.

- Budget for Fees: Remember that while a property hunter’s fees are paid by the buyer, their comprehensive service can save you both time and potential legal issues, making it a worthwhile investment.

Real Estate Dilemma: Go Classic or Go Hunter?

| Aspect | Traditional Real Estate Agent | Property Hunter |

|---|---|---|

| Motivation |

|

|

| Scope of Service |

|

|

| Legal Assurance |

|

|

| Time and Effort |

|

|

| Fees |

|

|

| Objectivity |

|

|

| Best For |

|

|

In short, a property hunter is often the better choice if you’re buying from a distance, can’t make frequent trips, or want to avoid the added cost of a lawyer and the hassle of doing research yourself. On the other hand, if you’re local and speak Spanish, working with a traditional real estate agent might be more suitable.

12. The Role of the Notary in Spain

In Spain, the notary plays a crucial role in the property buying process, acting as an impartial public official who ensures that the transaction is formalized according to Spanish law. However, it’s important to understand the limitations of the notary’s role to avoid misunderstandings about the legal safety of your purchase.

- Drafting the Public Deed (Escritura): The notary prepares the Escritura, the official document that transfers ownership from the seller to the buyer. This document includes the essential details of the sale, such as the property’s description, sale price, and any conditions agreed upon by both parties.

- Verifying Legal Compliance: While the notary ensures that the transaction complies with Spanish law, their role is limited. They will confirm the identity of the parties involved, check that the necessary taxes are paid, and verify that the property’s basic information matches the details in the Property Registry. However, the notary does not perform the in-depth legal checks necessary to uncover potential issues such as debts, liens, urbanistic compliance, or disputes over the property.

- Registering the Property: After the signing, the notary will send the deed to the Land Registry to record the change of ownership. This step is crucial as it legally registers you as the property’s new owner.

Crucial Legal Checks: Why You Need a Lawyer or Property Hunter with Legal Services

While the notary provides an essential service, they do not conduct thorough due diligence on the property. This is why hiring a lawyer or a property hunter with an integrated legal service is crucial:

- Lawyer: A lawyer specializes in conducting all necessary legal checks, such as verifying the property’s title, checking for existing debts or encumbrances, and ensuring urbanistic compliance. They safeguard your interests throughout the buying process, ensuring the property is legally sound.

- Property Hunter with Legal Services: If you opt for a property hunter, they often have an in-house legal team that conducts the same level of due diligence. They ensure that all documents are in order, perform translations if needed, and provide a full legal review of the property’s status.

Why This Matters:

Not relying solely on the notary for legal verification is essential because, without thorough due diligence, you risk acquiring a property with hidden issues that can lead to costly legal disputes or financial loss.

13. Common Mistakes to Avoid

Buying property in a foreign country can be challenging, and there are several common pitfalls to watch out for when purchasing in Spain:

- Skipping Legal Checks: One of the most critical errors is neglecting due diligence. Failing to verify the property’s legal status, including ownership and possible encumbrances, can lead to costly disputes later. Always hire a qualified lawyer to perform these checks thoroughly. For a more detailed discussion on this topic, refer to our article on What are the pitfalls of buying a property in Spain?.

- Underestimating Costs: Many buyers focus solely on the purchase price and overlook additional expenses such as taxes, notary fees, registration costs, and maintenance expenses. Make sure to budget for these to avoid financial strain. The article also highlights hidden costs and fees that can catch buyers off guard, stressing the importance of comprehensive financial planning.

- Not Understanding Local Regulations: Spain’s property laws can vary by region. For example, rules regarding property renovations, land use, and rental licenses differ from one area to another. Ensure you are well-informed about local regulations to avoid legal issues in the future. Cultural and language barriers can also complicate this process, making it crucial to hire bilingual professionals who understand the intricacies of Spanish property law.

To explore these and other potential pitfalls in more detail, check out our comprehensive guide: What are the pitfalls of buying a property in Spain?. This article covers everything from financial risks and market fluctuations to cultural differences and communication challenges, providing you with essential knowledge to ensure a successful property purchase in Spain.

14. Post-Purchase Considerations

Once you have successfully purchased a property in Spain, several post-purchase factors require attention to ensure that you can enjoy your new home without any worries:

- Property Maintenance and Management: If you do not reside in Spain year-round, consider hiring a property management company to handle maintenance, repairs, and any issues that arise. This service is especially useful if you plan to rent out the property to generate income.

- Insurance: Securing adequate insurance for your property is essential. Property insurance in Spain can cover various risks, including damage from natural disasters, theft, and accidents. Carefully review insurance policies to select coverage that suits your property’s needs.

- Community Fees: If your property is part of a residential complex or community (e.g., apartments or gated communities), you will likely need to pay community fees. These fees cover shared expenses such as building maintenance, security, and communal facilities like pools and gardens. It’s essential to factor these ongoing costs into your budget.

15. Future Property Market Trends in Spain

Spain’s economy shows promising growth, with a projected expansion of 2.1% in 2024 and 1.9% in 2025, driven by robust domestic demand and a resilient labor market. The implementation of the Recovery and Resilience Plan (RRP) is expected to boost investment, while headline inflation is projected to continue its downward trend. The unemployment rate is also forecasted to decline, further solidifying Spain’s economic recovery. Despite potential risks, particularly concerning external demand and private investment due to the economic health of Spain’s main trading partners, the Spanish real estate market remains relatively stable. This stability is supported by ongoing domestic demand, a strong labor market, and sustained interest from foreign investors. Staying informed on these economic trends is crucial for potential investors and property buyers, as they can significantly impact market dynamics in the coming years.

For more details on Spain’s economic outlook, visit the official European Commission’s economic forecast for Spain.

From Europe

From Europe From the UK

From the UK From the US

From the US