Understanding the Role of the Spanish Notary in a Real Estate Purchase

Last update: December 2, 2025

Reading time: 25.2 min

Why understanding the role of the Spanish notary is essential for foreign buyers

When buying property in Spain as a foreigner, it is crucial to understand exactly what the Spanish notary (notario) does — and what they do not do. Many international buyers assume the notary protects them throughout the entire transaction. This belief usually comes from familiarity with either the French or American system, where the function of a notary is very different.

That misunderstanding can lead to costly mistakes.

In Spain, the notario is a highly trained legal professional and a public official who ensures the legal formalities of the sale are properly executed. They verify identities, oversee the signing of the public deed (Escritura Pública), and confirm the transaction complies with Spanish law on its face. Their role is strictly neutral: they do not act on behalf of the buyer or the seller.

This differs significantly from other countries:

- In France, the notaire accompanies the buyer from the preliminary contract onward and conducts extensive due diligence on the property.

- In the United States, a notary public only witnesses signatures and has no legal advisory function.

- In Spain, the notary intervenes primarily at the final stage of the transaction and does not perform all the checks buyers might expect.

The Spanish notary formalizes the deal — they do not verify the entire legal situation of the property nor defend your interests.

That responsibility falls to an real estate lawyer (abogado), who must conduct due diligence before the notary signing.

Understanding these distinctions early allows foreign buyers to prepare the right legal support, avoid assumptions based on their home country’s system, and ensure a secure purchase process from start to finish.

No Time to Read It All? Here’s the Quick Summary:

What Does a Spanish Notary Actually Do?

Neutral public authority at the heart of the transaction

In Spain, the notary (notario) plays a central role in formalizing property sales, but their function is often misunderstood by foreign buyers. Far from being a personal advisor, the notary is a public legal official appointed by the Spanish state. Their mission is to give legal certainty to transactions — not to protect the buyer or seller individually.

Their involvement is neutral and formal: the notary does not take sides, does not negotiate on behalf of either party, and does not conduct in-depth checks on the property. Instead, they ensure that the legal framework of the sale is respected, and that all necessary elements are in place to make the transaction valid under Spanish law.

Here are the notary’s four main responsibilities in a real estate transaction:

1. Verifying the Identity and Legal Capacity of Both Parties

Before the deed is signed, the notary confirms the identity of the buyer and seller by reviewing their passports, Spanish tax identification numbers (NIE), and marital status. They also verify that both parties are legally capable of entering into the agreement — for example, checking if a spouse’s consent is required, or if a legal representative holds a valid power of attorney.

2. Drafting and Authenticating the Escritura Pública

The Escritura Pública is the notarized deed of sale — the legal document that officially records the change of ownership. The notary prepares this deed based on the information and documents provided by the parties (or their lawyers), reads it aloud during the signing, and ensures that both sides understand its contents. Once signed, the notary’s seal and signature give the deed full legal validity.

3. Collecting Certain Taxes and Transaction Fees

As part of the closing process, the Spanish notary is responsible for calculating and collecting certain taxes and transaction-related fees. This includes:

-

The Property Transfer Tax (ITP), which applies to resale homes.

-

Or, in the case of new properties, the Value Added Tax (VAT/IVA) and Stamp Duty (AJD).

These taxes are typically paid by the buyer and must be settled before the property can be registered.

In addition to taxes, the notary also collects notarial fees, which are regulated by Spanish law. These usually range from 0.2% to 0.5% of the declared property price, depending on the complexity of the deed and the number of parties involved.

Want to better understand how real estate taxes work in Spain — and how much you might pay in 2025?

Read this detailed guide: Real Estate Taxes in Spain: What Every Foreign Buyer Should Know in 2025

While the notary ensures these amounts are paid and correctly recorded in the deed, they do not provide tax planning or advice. For that, it’s important to work with a lawyer or tax advisor who can help you understand the full cost and implications of your purchase.

4. Sending the Deed to the Land Registry

After the deed is signed, the notary is responsible for submitting it to the Registro de la Propiedad (Land Registry) for official registration. This final step legally confirms the buyer as the new owner of the property and makes the sale public and enforceable.

In summary, the Spanish notary ensures that the sale complies with legal formalities, that taxes are settled, and that the deed is properly registered. However, they do not perform investigative checks on the property’s legal status — which is why hiring a lawyer remains essential.

What the Notary Does NOT Do

Critical legal checks you might assume are included — but aren’t

Despite their official status, Spanish notaries do not provide full legal protection to the buyer. This is one of the most common misconceptions among foreign purchasers, particularly those used to the French or American systems. While the notary gives the transaction its legal form and public legitimacy, they do not investigate the property’s legal risks beyond what is visible in official records.

Here’s what the Spanish notary does not do during a real estate transaction:

No Search for Hidden Debts, Charges, or Liens

The notary only reviews the current entry in the Land Registry. If a mortgage or lien is recorded there, it will be mentioned in the deed. However, they do not investigate off-record liabilities, such as:

- Unpaid community fees (e.g. in a condominium)

- Outstanding municipal taxes (like IBI)

- Private agreements or claims not recorded in the registry

These risks are real — and if they go unnoticed, they transfer to the buyer after the sale. It is up to your lawyer or advisor to uncover them before signing.

No Check of Urban Planning or Building Compliance

Notaries do not verify whether the property complies with local zoning laws or building regulations. That means they won’t flag:

- Illegal extensions or attic conversions

- Missing occupancy licenses (cédula de habitabilidad)

- Lack of planning permissions or unresolved sanctions

These issues can have serious consequences, including fines or the inability to use or resell the property. A notary will not visit the property or check with the town hall — these tasks fall outside their scope.

No Involvement in Preliminary Contracts or Negotiations

The notary typically only appears at the final signing. They do not:

- Draft or review the arras contract (deposit agreement)

- Negotiate the price or payment terms

- Advise on contract clauses or legal implications

- Participate in due diligence before the transaction

Buyers must engage a real estate lawyer (abogado) early in the process to handle these tasks. Without legal representation, you risk entering a contract with unclear terms or hidden pitfalls.

To be clear: the notary ensures that the act of sale is valid under Spanish law, but they do not guarantee that the property is free of legal, financial, or urbanistic issues. Those checks must be done independently, before the notary appointment, by professionals working in your interest.

Spanish Notary vs French Notaire vs U.S. Notary

A direct legal comparison — and why expectations matter

Foreign buyers often enter the Spanish property market with assumptions based on how things work at home. But not all notaries are created equal, and understanding how the Spanish notary compares to their French and U.S. counterparts is key to avoiding misunderstandings — and mistakes.

Role and Legal Function: A Comparative Overview

Let’s look at how notaries function in each legal system:

- Spain – Notario:

A highly trained legal professional and public official. The Spanish notary ensures the sale complies with legal formalities, verifies the identity and capacity of the parties, drafts and certifies the deed (escritura pública), and submits it to the Land Registry.

➤ Neutral role. Does not advise or protect either party. Appears mainly at the final signing. - France – Notaire:

Also a public legal officer, but with a much broader role. The French notaire is deeply involved from the beginning of the transaction, preparing the preliminary sales agreement, conducting legal checks on the property, verifying planning compliance, and handling the entire closing process.

➤ Protective role. Acts in the interest of both parties and ensures the property is legally clean. - U.S. – Notary Public:

Typically a non-lawyer who witnesses signatures and confirms identities. They have no role in drafting contracts or reviewing legal documents, and are not involved in real estate closings unless hired to witness paperwork.

➤ Administrative role. Offers no legal advice or guarantees.

Who Protects the Buyer?

- In France, buyers are often well-protected by the notaire, who handles much of the legal due diligence and provides advice.

- In the U.S., protection comes through private attorneys, escrow companies, and title insurance.

- In Spain, neither the notary nor a title insurance system provides full buyer protection. That role must be filled by your own lawyer.

Spanish notaries do not investigate potential risks or conduct in-depth legal research. Their job is to confirm that the documents presented are formally correct and that the deed is legally valid. They do not verify if the property is safe to buy — only that the sale is drafted according to Spanish law.

Why U.S. Buyers Must Adjust Their Expectations

American buyers are often surprised — and sometimes frustrated — by the limited scope of the Spanish notary’s role. In the U.S., many real estate transactions involve:

- Title companies verifying ownership

- Escrow services managing funds

- Attorneys advising on contracts and local law

None of these roles are automatically filled in Spain. Without title insurance or a full-service closing agent, American buyers must be more proactive — hiring a qualified abogado to handle due diligence, confirm the legal status of the property, and oversee every step of the process before the notary signs off.

Don’t assume the Spanish notary is a safety net. Their role is crucial — but limited. To protect yourself fully, you need legal guidance outside the notary’s office, especially if you’re used to the protections built into other systems.

Why You Still Need a Lawyer (Abogado)

The notary is not enough — here’s who actually protects you

While the Spanish notary plays a key role in giving legal form to a property sale, they do not protect the buyer from legal risks or investigate the background of the property. Their responsibility is to ensure the transaction meets legal formalities — nothing more. This is why working with an independent real estate lawyer (abogado) is not just recommended — it’s essential.

At SpainEasy, our legal team provides this crucial layer of protection. We act as your independent legal advisor throughout the entire buying process, ensuring your interests are safeguarded at every step.

Here’s how our legal service fills the gap the notary cannot cover:

Legal Verification of the Property

Before you sign anything, our legal team carries out full due diligence, including:

-

Verifying ownership and identifying any debts, charges, or encumbrances — even those not recorded in the Land Registry (e.g. unpaid taxes or community fees).

-

Obtaining and reviewing the nota simple and registry certificates.

-

Ensuring the property complies with urban planning regulations and holds all necessary permits and licenses (such as the cédula de habitabilidad).

-

Identifying any legal risks or irregularities that could affect your ownership.

These critical checks are not the notary’s responsibility — but they are at the core of what we do at SpainEasy Legal.

Legal Representation and Power of Attorney

If you’re purchasing from abroad or unable to attend key appointments in Spain, we can represent you through a notarized power of attorney. Our legal team will:

-

Sign the reservation contract and final deed on your behalf

-

Handle communications with the seller, estate agent, or bank

-

Pay taxes and fees within legal deadlines

-

Ensure the property is registered in your name properly and promptly

With SpainEasy, you have a trusted representative on the ground, defending your interests from start to finish.

Document Review, Translation, and Full Coordination

Most property documents in Spain are in Spanish — and notaries aren’t required to translate them. Our legal service ensures you fully understand what you’re signing:

-

We translate and explain the escritura pública and any related agreements in clear terms.

-

We review all contracts (including the arras contract) to protect your rights and prevent hidden liabilities.

-

We coordinate with all parties: notary, estate agent, seller’s lawyer, and the bank, to make sure every step is smooth and legally correct.

In short:

The notary ensures the act is legal — but only your lawyer ensures the property is safe to buy. Without legal representation, you’re exposed to hidden risks that could surface only after the deal is done. A qualified abogado offers the protection, clarity, and support every foreign buyer needs in Spain.

Step-by-Step: Real Estate Purchase in Spain

A simplified timeline — and when the notary gets involved

Buying property in Spain follows a relatively clear process, but it’s important to know who does what and when the notary enters the picture. Many foreign buyers wrongly believe the notary handles everything from the start — but in reality, their involvement is limited to the final stage of the transaction.

Here’s a simplified step-by-step overview of how the process works, and what you, as a buyer, need to prepare.

Step 1: Make an Offer and Negotiate the Terms

Once you’ve found a property you’re interested in, you (or your agent) submit an offer to the seller. Negotiations on price, inclusions (furnishings, repairs, etc.), and timelines take place at this stage.

Important: This phase is handled between the buyer, the seller, and possibly an agent — the notary is not yet involved.

Step 2: Hire a Lawyer for Due Diligence

As soon as the offer is accepted, hire a qualified real estate lawyer (abogado) to begin:

- Reviewing property documents (nota simple, registry details)

- Checking for debts, liens, and licenses

- Verifying urban planning compliance

- Preparing the arras contract (reservation/deposit agreement)

This legal review is essential. Do not skip it.

Step 3: Sign the Deposit Contract (Contrato de Arras)

This private contract outlines the key terms of the sale and typically involves a 10% deposit. It binds both parties to move forward.

The notary still does not intervene at this stage — this is between you and the seller, assisted by your lawyer.

Step 4: Prepare Your Legal and Financial Documents

Before the final signing, make sure the following are in place:

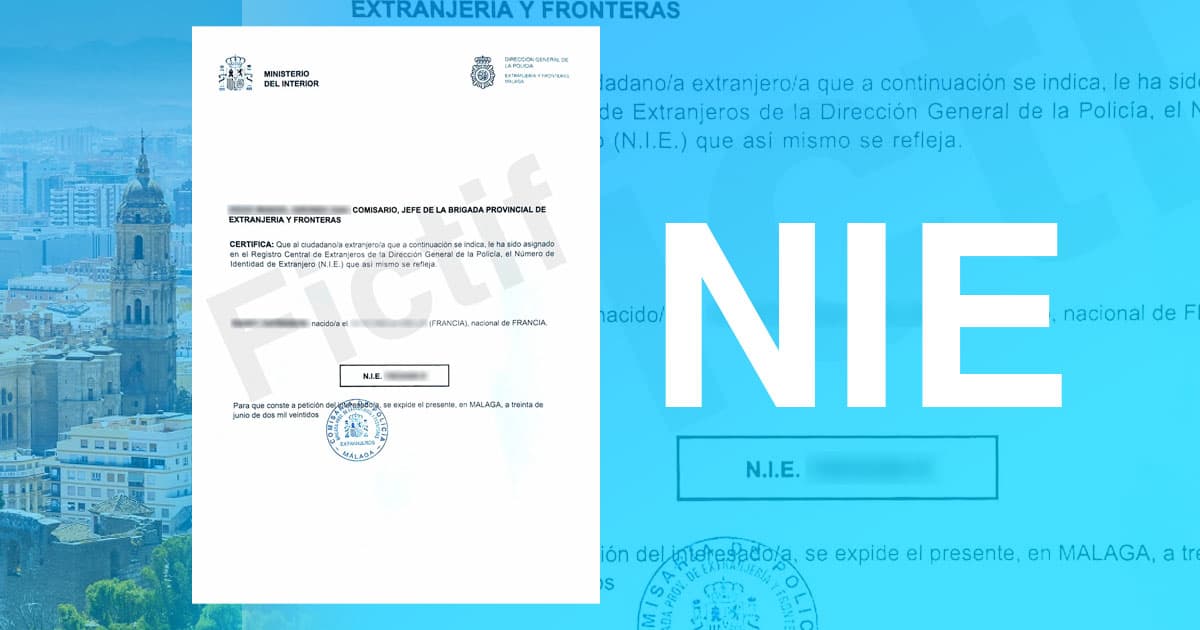

- NIE (Número de Identificación de Extranjero): This is your Spanish tax identification number — required for any property purchase. Apply through a Spanish consulate or in Spain.

- Spanish bank account: Needed to pay taxes, transfer funds, and manage ongoing expenses (utilities, community fees).

- Power of Attorney (if you won’t be in Spain): Your lawyer can represent you at closing if properly authorized.

Step 5: Schedule the Notary Appointment

Once the lawyer has completed the due diligence and confirmed everything is in order, a date is set for the signature of the Escritura Pública at the notary’s office.

This is when the notary steps in. Their role is to:

- Verify identities and legal capacity

- Draft and read the public deed

- Ensure payment is documented

- Certify and notarize the transaction

Step 6: Sign the Escritura and Pay the Purchase Price

At the notary’s office, the parties meet to:

- Review and sign the notarized deed

- Deliver the payment (usually via bank cheque or transfer)

- Handover keys and possession of the property

The notary will then affix their seal, making the sale official and legally binding.

Step 7: Pay Taxes and Register the Property

After the signing:

- Taxes (ITP or VAT + AJD) must be paid within 30 days

- The deed is submitted to the Land Registry for official recording of your ownership

These post-signing steps are often handled by your lawyer or a gestor, not the notary.

The notary plays a vital role, but only at the final stage of the purchase. The real work — due diligence, contract negotiation, tax strategy — happens before you reach their office. Make sure you’re fully prepared with all necessary documentation, funds, and professional support well in advance of the notarial appointment.

Costs and Fees: Notary, Taxes, and Legal Help

What foreign buyers should budget — and who pays what

Buying property in Spain involves more than just the purchase price. As a buyer, you’ll need to plan for a range of closing costs and legal fees that typically add up to 10–13% of the property’s value. Understanding these costs upfront helps avoid surprises and ensures a smooth transaction.

Here’s a breakdown of the main expenses involved, who is responsible for them, and how much you should expect to pay.

Who Pays What?

In Spain, the buyer usually pays all the closing costs, including:

- Notary fees

- Land Registry fees

- Taxes (Transfer Tax or VAT)

- Legal and advisory services

This is standard practice across most regions in Spain. The seller, in contrast, is generally responsible for their own capital gains tax and mortgage cancellation fees, if applicable.

Main Costs to Budget For

Let’s look at the key items in detail:

1. Transfer Tax (ITP) or VAT + AJD

- Resale properties: subject to the Property Transfer Tax (ITP)

- Rate varies by region, usually between 6% and 10%

- Example: 7% in Andalusia, 10% in Catalonia and Madrid

- Newly built properties: subject to VAT (IVA) and Stamp Duty (AJD)

- VAT: 10% on residential property

- AJD: 0.5% to 1.5%, depending on the region

These are the most significant costs in the transaction. Your lawyer or tax advisor will calculate the exact amount based on your case and region.

2. Notary Fees

- Regulated by law

- Typically range from €600 to €1,200, depending on:

- Property price

- Complexity of the transaction

- Number of parties involved

As a rough guide, you can estimate 0.2% to 0.5% of the purchase price.

3. Land Registry Fees

- Fees for registering the escritura pública in the Registro de la Propiedad

- Also regulated

- Usually €400 to €800, depending on the value and location of the property

4. Legal Fees (Lawyer or Abogado)

- Typically charged as:

- A fixed fee (from €1,000 to €2,500)

- Or a percentage of the purchase price (usually 1% + VAT)

This includes:

- Property checks (due diligence)

- Contract drafting/review

- Representation at the notary

- Post-sale registration and tax coordination

5. Gestor (Administrative Agent) – Optional

- If your lawyer does not handle taxes and paperwork, a gestor may assist

- Costs: €300 to €700, depending on scope

Example Budget for a €300,000 Property (Resale)

| Item | Estimated Cost |

|---|---|

| Transfer Tax (ITP @ 8%) | €24,000 |

| Notary Fees (0.3%) | €900 |

| Land Registry Fees | €600 |

| Legal Fees (1%) | €3,000 |

| Total Estimated Closing Costs | €28,500 (≈9.5%) |

Transfer Tax (ITP @ 8%)

€24,000

Notary Fees (0.3%)

€900

Land Registry Fees

€600

Legal Fees (1%)

€3,000

Total Estimated Closing Costs

€28,500 (≈9.5%)

Add 1–2% more if the property is new and subject to VAT and AJD.

Final Thoughts on Budgeting

- These costs are usually due at the time of signing or shortly afterward.

- Most buyers pay via bank cheque or direct transfer prepared in advance.

- Always clarify with your lawyer who pays what and when — especially for taxes.

Key tip: Even though the notary collects some of the taxes and fees, they do not provide personalized tax advice or optimize your tax structure. That’s the role of your lawyer or accountant — and one more reason why relying solely on the notary is not enough.

Common Mistakes Foreign Buyers Make

Avoid these pitfalls when buying property in Spain

Buying real estate in a foreign country comes with its challenges — and Spain is no exception. Many international buyers, especially from the U.S. or France, enter the Spanish property market with certain assumptions based on how things work in their home country. This often leads to avoidable mistakes that can cost both time and money.

Below are the most common errors foreign buyers make when purchasing property in Spain — and how to avoid them.

Relying Solely on the Notary

One of the biggest misconceptions is believing that the notary will protect your interests throughout the process. While the notary is a critical figure in finalizing the transaction, their role is strictly limited to verifying identities, certifying the deed, and ensuring the transaction meets formal legal requirements.

They do not:

- Investigate property history

- Check for hidden liabilities

- Advise on tax or legal strategy

Solution: Always hire a real estate lawyer (abogado) early in the process. They represent you — the notary doesn’t.

Failing to Check for Debts or Legal Issues

In Spain, outstanding debts such as:

- Unpaid community fees

- Municipal taxes (IBI)

- Private liens or claims

can stay attached to the property, even after the sale.

Buyers who assume the notary verifies these issues are often left with unexpected liabilities.

Solution: Your lawyer must request a nota simple, check utility and community receipts, and confirm tax payments to ensure the property is free of debt.

Underestimating Post-Signing Costs

Many buyers focus solely on the purchase price and forget about the additional costs that come after signing the deed. These include:

- Transfer tax or VAT (6%–10% or more)

- Notary and registration fees

- Legal fees

- Potential renovation costs or administrative fines if the property is not compliant

Solution: Budget an additional 10–13% of the purchase price to cover all transaction-related expenses, and verify urban compliance before purchase.

Not Reviewing the Deed in Advance

Some buyers show up at the notary appointment without having properly reviewed the Escritura Pública (the official deed). Since notaries often read it in Spanish, non-native speakers may not understand key terms at the moment of signing.

Solution: Ask your lawyer to review and explain the deed before the appointment. Request a draft copy in advance, and use a certified translator if needed.

Assuming Everything is Legal Because It Looks Good

A well-presented property may still have serious issues:

- Illegal extensions

- Missing occupancy licenses

- Unpaid fines or construction violations

If these are not identified before closing, the buyer inherits the problem.

Solution: Have your lawyer or a local architect verify that the property complies with planning and building regulations.

The most common mistakes stem from assuming that Spain’s system offers the same protections as elsewhere. But in reality, buyers must be proactive, well-advised, and financially prepared. By avoiding these errors, you reduce your risk and ensure your investment is legally sound and stress-free.

Practical Tips for U.S. Buyers

How to navigate the Spanish property system with confidence

For U.S. buyers, the Spanish real estate process can feel unfamiliar and, at times, confusing. The legal system, administrative requirements, and cultural expectations differ significantly from those in the United States. To ensure a secure and efficient purchase, here are some practical tips specifically for American investors or homebuyers entering the Spanish market.

Don’t Forget Your NIE — It’s Mandatory

Before you can purchase property in Spain, open a bank account, or pay taxes, you’ll need a Número de Identificación de Extranjero (NIE) — your Spanish tax identification number.

- It’s required at every stage: from signing contracts to registering the deed.

- You can apply for it in Spain or through a Spanish consulate in the U.S.

- Processing times vary, so apply early in the process.

Without an NIE, you cannot legally complete the purchase.

Understand That Legal Culture Works Differently

In the U.S., buyers are used to title companies, escrow accounts, and realtors who coordinate everything. In Spain, the process is more fragmented — and certain safety nets simply don’t exist:

- No title insurance as standard

- No escrow system for holding funds

- Notaries do not act as legal advisors

- Buyer due diligence is the buyer’s responsibility

You must take a more hands-on role and surround yourself with qualified local professionals: a lawyer, a real estate advisor, and possibly a gestor.

Anticipate Language Barriers and Plan for Translations

Most official documents — including the escritura pública — will be written and read in Spanish. Notaries are not required to provide translations, and not all of them speak English fluently.

- Never sign anything you do not fully understand.

- Ask your lawyer to provide a certified English translation of all key documents.

- If attending the notary appointment in person, bring an interpreter if needed.

Misunderstandings due to language can lead to costly errors. Don’t rely on assumptions — insist on clarity.

Prepare for the Total Cost — Not Just the Price Tag

U.S. buyers are often surprised by the number of additional costs involved, such as:

- Transfer tax or VAT (6–10% or more)

- Notary and registry fees

- Lawyer’s fees

- Currency conversion and international transfers

Plan for 10–13% in additional costs, and confirm payment logistics in advance.

Be Patient and Flexible with Spanish Bureaucracy

Spain’s administrative pace may feel slow compared to U.S. standards. Document processing, bank operations, and government paperwork often take longer than expected.

- Build in extra time for each step

- Be ready for occasional delays in appointments or approvals

- Always keep digital and physical copies of all documents

Patience is key. Rushing the process leads to mistakes.

Buying property in Spain as a U.S. citizen is absolutely achievable — and often very rewarding — but it requires preparation, the right advisors, and a clear understanding of how the Spanish legal and cultural environment differs. With the right team and mindset, you can navigate the process smoothly and confidently.

The Spanish Notary Is Essential — But Not Enough to Protect You

If you’re buying property in Spain, working with a notary (notario) is legally required — but relying on the notary alone is a common and potentially costly mistake. While they play a critical role in certifying and formalizing the transaction, their function is limited to legal validation, not legal investigation or buyer protection.

To truly secure your investment, the winning combination is clear:

Notary + Lawyer + Local Advisor.

Your lawyer ensures the property is free of debts, compliant with local regulations, and that all contracts are in your best interest. A trusted local advisor or property consultant can help navigate cultural and administrative nuances, especially if you’re buying from abroad.

In the Spanish legal system, the buyer must remain proactive. With the right team in place, your purchase can be smooth, legally sound, and free of unpleasant surprises. Don’t assume the system works like at home — prepare, verify, and surround yourself with professionals who are firmly on your side.

Need help managing the entire process from start to finish?

At SpainEasy, we offer complete, personalised support — from due diligence to notary signing — to make your property purchase in Spain safe, smooth, and stress-free.

Pro Tip

The Spanish mortgage process has more formalities than in the U.S., but it’s manageable with preparation. Start early with your NIE and banking setup, get pre-approved before committing to a property, and allow 2–3 months for the full process.